Critical Illness Insurance

How does critical illness insurance work?

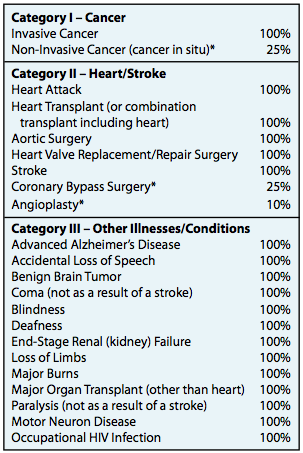

Assurity’s fully underwritten Critical Illness Insurance policy pays benefits at the insured person’s first-ever diagnosis of one of 21 covered illnesses or procedures.

Guaranteed renewable for life, this protection is available for individuals 18 through 64 years of age and offers benefits from $50,000 to $500,000. An outstanding feature, the Return of Premium Death Benefit returns 100 percent of paid premiums (less any benefits received) to the beneficiary if the insured dies of any cause other than a covered illness.

How can the benefits pay on a $100,000 policy?

- If you are diagnosed with invasive cancer, you would receive $100,000. Category I would be depleted.

- Three years later, if you have a heart attack, you would receive another check for $100,000. Category II would be depleted.

- Five years later, if you are diagnosed with end stage renal failure, you would receive another check for $100,000. Category III would be depleted.

With this example, if you have a $100,000 benefit, this policy could potentially pay you $300,000!

It’s not just the medical costs that stack up. It’s also the ones you never planned for!

Even with great health insurance, there are a number of hidden costs associated with critical illness.

Co-pays, transportation, prescriptions, experimental treatments and a host of other bills may overwhelm you, just when you should be focused on recovery.

A critical illness policy from Assurity Life can help provide the funds needed to meet the unexpected costs that can arise from a serious medical situation.

Critical illness pays a lump-sum benefit upon the first confirmed diagnosis of a covered illness or medical

procedure. This money can be used in any manner you choose – pay off credit cards, pay mortgage or utility bills, take a vacation or any other purpose.

* Payable once per lifetime. |

(866) 750-6053

Critical Illness Insurance for Men

Example Monthly Rates |

| Age |

Monthly Premium $50,000 Death Benefit Amount |

Monthly Premium $100,000 Death Benefit Amount |

| 30 |

$34.76 |

$57.82 |

| 40 |

$49.32 |

$83.34 |

| 50 |

$73.61 |

$127.07 |

Critical Illness Insurance for Women

Example Monthly Rates |

| Age |

Monthly Premium $50,000 Death Benefit Amount |

Monthly Premium $100,000 Death Benefit Amount |

| 30 |

$28.69 |

$46.90 |

| 40 |

$40.83 |

$68.73 |

| 50 |

$57.24 |

$96.71 |

|